Favorite native plant or animal: Coastal Mugwort (Artemisia suksdorfii)

Favorite thing to do around the Bay Area: Exploring the magic of Mt. Tam

Superpower: Talk to trees via the mycorrhizal network

Jill grew up on the Peninsula, and after four years of living on the East Coast, is excited to be back in the Bay community. She comes to Save The Bay with a B.S in Biology and Environmental Science from Tufts University, and a background in environmental education and backcountry guiding. She finds great joy in empowering folks of all ages in hands-on outdoor exploration, and is excited to continue working to make the outdoors an inclusive and accessible space for all. In her free time, you can find her climbing on rocks big and small, and biking through the area.

Favorite native plant or animal: Poppies!

Favorite thing to do around the Bay Area: Watch the sunset from the Berkeley hills

Superpower: Speak every language (animal and human)

AmyBeth (she/her) is a Political Organizer at Save the Bay, where she focuses on nurturing partnerships with coalitions and community organizations working on green stormwater infrastructure, affordable housing, and toxic sites impacted by sea level and groundwater rise. Her background is in faith-based organizing for immigrant rights alongside undocumented communities in Southern Arizona. She believes undoing oppressive systems requires all of us, and that we must prioritize the concerns of marginalized communities at the front lines of environmental issues. In her free time, she loves to sing, hike, and hang out with her cat Rosy.

Favorite native plant or animal:

Harbor Porpoise – a recovery story directly in line with Save The Bay’s work! Better water quality is one of the contributing factors.

Favorite thing to do around the Bay Area:

Spotting birds while swimming in the Bay

Superpower:

Being a Babel Fish – able to understand the communication of all beings

Masha is a strategic leader, fundraiser, and storyteller whose experience was forged building successful community-based initiatives. She is passionate about working with people to put their values into action. Born in the Soviet Union, Masha came to the United States as a refugee. Prior to Save The Bay, her career was mainly in human services, particularly fundraising for refugee resettlement and community-building led by and for former refugees. She is a Certified California Naturalist, a Master Birder in training, and enjoys swimming in, birding on and around, and rowing on the Bay.

Favorite native plant or animal: Sticky Monkey Flower

Favorite thing to do around the Bay Area: Explore new hiking trails in all nine Bay Area counties with my dog, Klondike

Superpower: Control the Weather

Gwendolyn’s passion for mission-driven work is everlasting. She is a visionary, where strategy, creativity and passion are the hallmarks of her 25-year career in fundraising and communications. She values and invests in building a collaborative team environment that develops farseeing strategies, effective organizational structures, and impactful results. In her spare time, mountain trails and ridge lines are where she roams with her family and their dog, Klondike.

Groundwater and sea level rise threaten vulnerable communities by displacing toxic contamination.

The AstraZeneca site on the Richmond shoreline was once the site of sulfuric acid, pesticide, and fertilizer manufacturing. Because of this industrial pollution, it is now contaminated with high levels of toxins such as benzene, lead, arsenic, uranium, and pesticides like DDT. So far, cleanup efforts have included leaving contaminated soil on site and “capping” it by placing concrete on top. The City of Richmond has plans to build up to 4,000 housing units on top of this contaminated land. However, as sea levels rise, groundwater will also be pushed up to the surface, potentially pushing the toxins into pipes and through cracked concrete, putting the health of residents and surrounding communities at risk.

For decades, frontline community members in Richmond have been raising awareness about the health and environmental threats posed by groundwater and sea level rise displacing toxic contaminants on industrial sites. Because of a long history of racist policies, the communities surrounding these sites are largely low-income communities of color. They are advocating for full cleanup of the AstraZeneca site before any housing is built on it, rather than simply capping contamination in place. This would involve removing all contamination from the site and taking it to a safer storage or treatment site. The Department of Toxic Substances Control (DTSC), which oversees cleanup of the site, should require AstraZeneca to conduct a full cleanup. Additionally, groundwater and sea level rise should be considered in all toxic site cleanup efforts.

Richmond Shoreline Alliance (Sunflower Alliance, Greenaction, Sierra Club, CESP, Point Molate Alliance, Richmond Progressive Alliance)

Favorite native plant or animal: Redwood trees

Favorite thing to do around the Bay Area: Swimming in Aquatic Park

Superpower: Flying

Peter works for the J.P. Morgan Private Bank, where he provides investment and planning advice for wealthy families. Though he grew up on the East Coast, he has now lived for over a decade in the Bay Area and is committed to preserving and protecting the ecosystems and natural resources of his adopted home. He is also looking forward to continuing the legacy of his wife’s family, who have been strong conservationists in and around the Bay Area for over 100 years, and to instilling an appreciation for the beauty of California in his two small children. Peter holds a law degree from Santa Clara University and. B.A. from Dartmouth College, where he was an Environmental Studies major.

Favorite native plant or animal: CA Quail, I love the way they walk as their little head plumes bop around

Favorite thing to do around the Bay Area: CA Bay Laurel, the leaves smell amazing

Superpower: Immortality, there is so much to see and do in this world, and I would probably try a lot of things if I didn’t have to worry about dying 😎

Hillary is an administrative generalist with a wide range of professional experience. She’s had many fun and interesting jobs, including harvesting walnuts, running a woodshop, and sculpting giant props for parade floats, but especially enjoys work that benefits her community in some way. When not working, she spends time gardening, cooking, working on crafts or repair projects, and seeing live music.

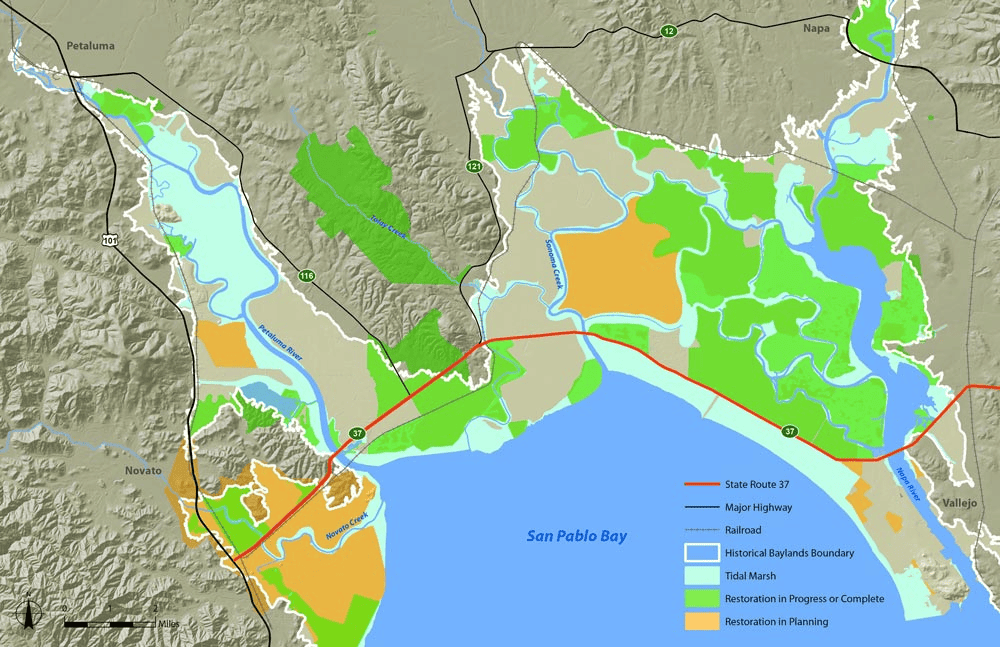

Highway 37 will soon be underwater. The highway’s redesign, if done correctly, offers an opportunity to build climate-resilient infrastructure and restore 20,000 acres of wetlands.

Highway 37 sits on a levee in San Pablo Bay in the north Bay Area. In 2017, the highway was shut down for a month due to flooding caused by a combination of King Tides and winter storms. During the atmospheric rivers in January 2023, the highway was again closed for a weekend when it flooded due to Novato Creek overflowing. These closures will likely happen again and again as sea levels rise if no action is taken. This would disrupt 40,000 daily car trips which people depend on to get them to jobs in Marin, Sonoma, Napa and Solano Counties. Additionally, the levee that the highway sits on currently blocks natural tide flow from San Pablo Bay to wetlands on the north side of the highway.

The redesign of Highway 37 is currently in the early planning stages. One of the proposed designs is to build the highway on an elevated causeway. This would put the highway above the reach of rising sea levels while also letting water ebb and flow with natural tidal action between San Pablo Bay and the wetlands beyond the highway. Once these 20,000 acres of wetlands are reconnected with the natural flow of tides, they can be restored to their full function, providing habitat, carbon sequestration, and flood resilience benefits.

Photo: Sonoma Land Trust

SR 37 Baylands Group (Audubon California, California Department of Fish and Wildlife, Ducks Unlimited Inc., Marin Audubon, Marin Conservation League, Point Blue Conservation Science, San Francisco Bay Joint Venture, San Francisco Bay Regional Water Quality Control Board,. San Francisco Estuary Institute,. San Pablo Bay National Wildlife Refuge, U.S. Fish and Wildlife Service, Save The Bay, Sonoma Land Trust,. State Coastal Conservancy)

Of all the counties in California, San Mateo County is the most vulnerable to sea level rise.

Sea Level Rise

Sea levels could rise by up to 3.3 feet in San Mateo County by 2070 and 6 feet by 2100 according to the county’s Sea Level Rise Vulnerability Assessment. While the whole Bay Area will experience rising seas, San Mateo County is particularly vulnerable, with over 30,000 homes, dozens of schools and hospitals, and over 7,000 acres of wetlands at risk of flooding by 2070. Historically underinvested communities will be the most at risk when flooding occurs because historic inequities placed affordable housing in higher flood risk areas and because they are more vulnerable to economic damages incurred.

Inland Flooding

Not all flooding happens at the coast. As storms and groundwater rise become more extreme, Bay Area communities will continue to be impacted by flooded streets and homes due to outdated stormwater infrastructure. Additionally, urban areas are primarily covered in concrete, asphalt, and other surfaces that don’t allow water to seep through. This means that during storms, rainwater runs off these surfaces picking up pollutants (like motor oil, chemicals, and trash) on its way to creeks and the Bay.

Sea Level Rise

Preparing the county for sea level rise will require a coordinated effort among cities to plan and implement solutions such as wetland restoration, horizontal levees, and sea walls. San Mateo County has taken steps in this direction with the creation of OneShoreline, a government agency that works across jurisdictional boundaries to plan and implement sea level rise resilience measures in the county. The County also conducted a countywide Sea Level Rise Vulnerability Assessment to identify areas that will be impacted by flooding and erosion and provide solutions.

This coordinated effort should be replicated across the Bay Area. Cooperation between cities and counties throughout the Bay Area is necessary to ensure that shoreline protection in one area doesn’t result in greater flooding in others. This could happen, for example, when a sea wall in one city deflects storm surges towards an adjacent city without flood protections. There should also be coordination at the state and federal level to provide funding to low-income cities that may not otherwise have resources for sea level rise planning. The San Francisco Bay Conservation and Development Commission (BCDC) is currently creating guidelines to shape local sea level rise plans.

Inland Flooding

Cities must invest in updated stormwater infrastructure to reduce flooding and capture and clean stormwater before it reaches our waterways. In particular, green stormwater infrastructure (GSI) uses natural systems like vegetation, soil, and permeable surfaces to capture stormwater and filter out pollutants. Examples include rain gardens, bioswales, and tree wells. When cities upgrade streets, parks, and other infrastructure, they could be incorporating GSI at the same time, making these new investments more flood resilient. San Mateo County is supporting this kind of integrated planning with their Sustainable Streets Master Plan.

OneShoreline, County of San Mateo

Favorite native plant or animal:

Matilija Poppy (Romneya coulteri)

Favorite thing to do around the Bay Area:

Outdoor concerts

Superpower:

Teleportation

Delanie is a visual communications designer with experience in marketing and development in-house for non-profit, scientific, and environmental institutions. She specializes in graphic design, video production, branding, and content strategy. Outside of work she enjoys running, hiking, and crafting.

Favorite native plant or animal: Bougainvillea

Favorite thing to do around the Bay Area: Visiting museums, all types of museums

Superpower: Time Traveling

Abraham’s inspiring life story and his own lived experience as an immigrant from Mexico have led him to Diversity, Equity, and Inclusion (DEI) work, and he’s built an extensive background as a DEI leader, crafting racial equity and inclusion programs within city and government agencies across Washington state. He has worked with large and diverse staffs at public serving agencies in the Seattle area, including school districts and regional transit agencies. His academic background includes electrical engineering and systems administration degrees, as well as certifications in executive leadership and Equity & Inclusion.

Favorite native plant or animal: Western maidenhair fern

Favorite thing to do around the Bay Area: Jam at the beach!

Superpower: Shape Shifting

Haymar (she/they) grew up bicoastally in California and New York. Her love for estuaries and environmental justice began in high school with her involvement with the Village Community Boathouse, an organization providing free public rowing and estuary education in New York Harbor. Haymar’s work at McGill University, the Waquoit Bay National Estuarine Research Reserve, the Yurok Tribe Environmental Program and Richardson Bay Audubon has brought her to Save The Bay with a deep sense of purpose to serve the most vulnerable, be they wildlife or human. Her hobbies include photography, songwriting, knitting, rock climbing, hiking and generally existing outdoors.

Favorite native plant or animal: Yarrow and Sitcky monkey-flower but I love anything that smells amazing, like Mugwort and White Pitcher Sage. There are too many to pick!

Favorite thing to do around the Bay Area: Going to new eateries! I love trying new foods and all different kinds of cuisines! Food has always been an important part of my culture and upbringing. The Bay Area is really special in that way, there is so much culture and diversity.

Superpower: Teleportation! That way I could visit my hometown in LA often while doing life in the Bay (and travel all over the world).

Daniella (she/her) is a first-generation Latinx, born and raised in LA. She graduated from Davis with a B.S. in Environmental Policy Analysis and Planning and an emphasis in Conservation Management. Daniella is extremely passionate about working in the field of environmental education and restoration, specifically making it an accessible and inclusive space for all! Coming from the STRAW program at Point Blue, Daniella has experience in transition zone, tidal marsh, and riparian restoration with kiddos. She looks forward to collaborating with more communities throughout the Bay Area. Daniella’s hobbies include: reading, eating new food, breweries, music (especially festivals and shows), rewatching New Girl and then doing it again, and loving on her cat.

Favorite native plant or animal: California sea lion

Favorite thing to do around the Bay Area: Trying new restaurants and going to 49ers, Giants, and Warriors games

Superpower: Teleportation

Cameron was born and raised in Tracy, California and moved to San Jose to attend San Jose State University. He recently graduated in May 2022 with a bachelor’s degree in computer engineering. Outside of school and work, Cameron enjoys going to the gym, playing recreational basketball, watching sports, new movies and TV shows, along with learning how to cook new meals.

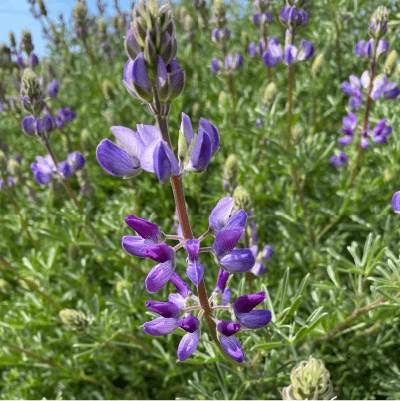

Favorite native plant or animal: Sky Lupine

Favorite thing to do around the Bay Area: Reading a book outdoors and spending time among redwoods

Superpower: Telekinesis

Having grown up in the Bay Area, Erin is excited to join Save The Bay and work towards equitable climate policies for the region. Her previous experience includes advocating for renewable energy policy at Environment New Mexico and working on California local government outreach and engagement programs at SGA Marketing. Outside of work, she enjoys reading, painting, and being outdoors.

GianCarlo “Charlie” Onorati was born and raised in LA and grew up exploring the Santa Monica Mountains. In 2014 he moved to the Bay Area in 2014 to teach at San Mateo Outdoor Education and has stayed in the Bay ever since. He has worked in youth development and environmental education all over California and loves to bring students out to the shoreline to explore their connection and build a sense of responsibility. Charlie likes to return to the redwoods frequently and hike and explore all over the region.

Favorite native plant or animal:

Silver lupine (Lupinus albifrons)

Favorite thing to do around the Bay Area:

Play with my dog and everyone else’s dog at Point Isabel

Superpower:

The ability to speak and understand all languages

Leslie is the Individual Giving Officer at Save The Bay and is proud to support building climate resiliency in the place she calls home. Prior to joining us, Leslie spent seven years engaging the vibrant Oakland and Bay Area community through visitor experience and membership at the Oakland Museum of California. In her downtime, you can find her arranging florals and getting muddy with her family and dog, Moose.

Favorite native plant or animal:

Hummingbird Sage (Salvia spathacea) and Plainfin Midshipmen (Porichthys notatus)

Favorite thing to do around the Bay Area:

Tide pooling

Superpower:

Telekinesis

Alyssa Alfonso is a second-generation Filipino American that was born and raised in San Francisco. Her excitement for the natural world began at young age exploring local beaches and tide pools around the Bay Area. She is passionate about wildlife conservation and creating an environmental and social impact through habitat restoration of the San Francisco Bay. On her free time, you can find her splitting pins at local bowling alleys and exploring trails with her dog, Jack.

Favorite native plant or animal:

Redwoods

Favorite thing to do around the Bay Area:

Bike through Tilden Regional Park

Superpower:

End climate change and rebuild resilient ecosystems

Hayley is a Save The Bay Policy Manager focused on equitable climate resilience. She focuses on multi-benefit green infrastructure, ensuring our region’s land use planning is addressing the impacts of climate change. Before joining Save The Bay’s team, she worked on land use planning policy advocacy related to transportation, housing, open space, and agriculture at Greenbelt Alliance and TransForm. She is passionate about deconstructing systems of oppression and ensuring our land and water ecosystems are healthy and abundant. She has a master’s in Environmental Policy and Planning and Environmental Justice from the University of Michigan School for Environment and Sustainability. When not advocating, Hayley can be found puttering in her garden or swimming in alpine lakes.

Favorite native plant or animal: Leopard lily

Favorite thing to do around the Bay Area: Skate through GGP to Ocean Beach!

Superpower: Earth bending

Kiera Jordan is from Auburn, California and grew up with a strong connection to nature. She studied Earth Science and Anthropology at UC Santa Cruz and has since worked in various outdoor education, recreation, and conservation positions all over NorCal. Outside of work, she’s a big fan of traveling, skateboarding, dancing, and reading.

Donnie joined the Board of Save The Bay in 2011 after working on a successful campaign to defeat California’s Prop 23, which would have overturned California’s climate and clean energy laws. Fowler regularly braves the annual Escape from Alcatraz Triathlon. He asks, “How lucky are Bay Area residents to be able to experience all this in our backyard?”

Favorite thing to do around the Bay Area:

Going for a hike or jog along the trails

Superpower:

Teleportation

A Bay Area native, Armello shares Save The Bay’s mission of delivering a brighter future to all, in particular for low-income communities that are disparately impacted by climate change. Over more than 15 years in the financial services industry, Armello has partnered with many small to medium sized firms to help them achieve their growth objectives, including as a VP on Bank of America’s Global Commercial Banking team. He enjoys sports, traveling, and spending time with his wife and two daughters.

Favorite native plant or animal:

The adorable Gray Fox that lives in the Baylands

Favorite thing to do around the Bay Area:

Definitely biking along the Bay Trail or walking at Palo Alto Baylands Nature Preserve. But a sailing trip near the Golden Gate Bridge at sunset can’t be beat!

Superpower:

Healing! Wouldn’t it be incredible to have a Healing super power?

Lauren manages sustainability for Meta’s Facilities team where she directs green building initiatives, as well as renewable energy and water projects. Since joining Meta, she’s been partnering with local and regional nonprofits to help protect and restore the natural environment, including the wetlands and endangered species adjacent to Meta’s headquarters.

Favorite native plant or animal:

Burrowing Owl – Owls are my spirit animal and I love how the small, charming Burrowing Owl has had such a huge influence on projects impacting the environment in the Bay Area

Favorite thing to do around the Bay Area:

I love riding my bike, birding and taking photos – all the better if all three are done on the same trip!

Superpower:

Converting micro plastics into sustainable transportation for all

Steve is a Bay Area native whose fondness of hiking and bicycling give him a deep appreciation for this area. He is a director of engineering at Adobe and spends much of his time figuring out how to build solutions for the benefit of all. He joined the board of Save The Bay to bring his love of the environment and the Bay Area, along with his technical skills, to help preserve the beauty of the San Francisco Bay for everyone to enjoy.

Favorite native plant or animal:

Giant trillium (Trillium chloropetalum)

Favorite thing to do around the Bay Area:

Walk among redwoods

Superpower:

If I had a superpower, it would be the ability to teleport myself back 300 years, and fly over California. I would start at the Bay, which of course would be ringed with beautiful marshes, and then on through the valley to the Sierras, looking down on waterfalls, rivers, and forests teeming with insects, birds, animals, and wildflowers. No freeways, no buildings, no dams, no transmission lines, just the occasional pueblo or canoe in a marsh!

I currently work at Meta, with the Sustainability and Data for Good teams. In the past I have worked in the tech sector and in the tech-for-good space, developing tools to further labor and disability rights. In my spare time, I work with a bunch of amazing kids at a local robotics team. Lately, I have become very interested in regeneration and nature based solutions, and so am very excited to be a part of Save the Bay!

Favorite native plant or animal:

Valley Oaks—My searing image of N California came from a trip from Colorado to SF while in college and I saw the beautiful dusty green oaks on golden hillsides. I was determined to have a home with an Oak… fortunately today we have 200 Oaks on our property

Favorite thing to do around the Bay Area:

Hiking around the Bay and above on the hills where you can see the Bay

Superpower:

Levitation—I would be able to calmly lift my arms to the sky and levitate and fly around

Dennis is a retired partner from Fenwick & West, where he provided strategic legal and business advice to startups and publicly traded companies. A long-time Bay Area resident, Dennis is committed to addressing climate change and environmental inequities through the restoration and preservation of the Bay and surrounding environment. Dennis serves on the Boards of Peninsula Open Space Trust and Pie Ranch, and Stanford’s Jasper Ridge Biological Preserve Advisory Council. Dennis and his wife are avid hikers and cultural and culinary enthusiasts.

Terry is a scientist who has dedicated her professional life to protecting the environment, most recently as Chair of the San Francisco Regional Water Quality Control Board. Her earlier work included advising Bay Area environmental groups and serving on USEPA’s Science Advisory Board. Terry appreciates Save The Bay’s focus on nature-based solutions to the challenges of climate change and new-generation chemical pollution.

Favorite native plant or animal:

Lupine (good in nature and hopefully the home garden too)

Favorite thing to do around the Bay Area:

Anything close to the water! Hiking, Sailing, whatever gets us outdoors

Superpower:

Predicting the Bay Area weather? Or teleportation, it would make commuting a lot easier

Hugh Le is a partner at Strategy&, PwC, focusing on ESG (Environmental, Social, and Governance) and helping companies address climate resiliency and the clean energy transition. He is passionate about protecting our Bay and bringing together solutions across business, policy, education, and individual change. He enjoys spending his time alongside the Bay as well as weekends on the water.

Katherine Tsay is a Business Development Manager at LinkedIn and is responsible for leading product integrations with partners for LinkedIn Talent Solutions. Outside of her day job, Katherine is passionate about encouraging her colleagues to live more sustainably as a member of LinkedIn’s Go Green team. Her interest in environmental advocacy stems from her passion to fight economic injustice and prevent low-income communities from continuing to bear the brunt of climate change.

Favorite native plant or animal:

Valley Oak

Favorite thing to do around the Bay Area:

Biking on the Alviso levees and seeing birds

Superpower:

Create a plastic eating microbe

Suresh has been volunteering with Save The Bay since 2005, and supports our work not only by getting his hands dirty out on the shoreline, but also by being a dedicated donor. He has increased his impact through employee matching gifts programs and has nominated Save The Bay to be considered for various grants.

Jay Pierrepont is a Principle and the President/COO of Asset Management of Equilibrium, a firm with sustainability at its core. Originally from New York, he settled in San Francisco where you might find him acing sailing lessons.

Favorite native plant or animal:

Redwood tree

Favorite thing to do around the Bay Area:

Hike and golf along Land’s End Trail

Superpower:

Flying

Juliana has been advising wealthy families since 2002 and authored The Abundance Loop: 8 Steps to Manifest Conscious Wealth. Her mission is to shift people from a scarcity mindset to one of abundance about their money, their life, and their environment. Juliana enjoys restoring wetlands and supporting Save The Bay alongside her daughter.

Melissa Mangini is a Director of Marketing at LinkedIn, where she is committed to their vision of creating economic opportunity for every member of the global workforce. A Bay Area native, Melissa spends as much time outdoors as possible, exploring the natural world with her husband and dog. She is passionate about using her marketing experience to drive awareness of sustainable living practices and how we can confront climate change together.

Sam is an Environmental Scientist originally from landlocked Great Falls, Montana. He’s spent nearly 45 years studying the Palo Alto Baylands, which he calls “a wonderful example of where wetlands meet mudflats.” Sam’s focus is on fighting shoreline development and supporting wetland restoration as a means of flood control as sea levels rise.

As Head of Global Client Services for Moody’s ESG Solutions, Yoon works closely with investors, corporations, and governments to assess financial and economic exposure to ESG and climate risks and support the integration of these considerations into decision-making. Yoon has dedicated her career to promoting positive change through her climate change adaptation work in California, the U.S. and in developing countries. As an avid hiker and backpacker, she is keenly interested in protecting, restoring and enjoying the critical ecosystems and natural resources that uniquely characterize the Bay Area.

Favorite native plant or animal:

Bobcat

Favorite thing to do around the Bay Area:

Sailing on Save The Bay’s annual catamaran excursion

Superpower:

Time travel

Chris is a retired partner in Davis Polk’s Northern California office, where he focused on complex litigation and strategic problem solving for leading businesses. He currently serves as a mediator in business cases and teaches courses on antitrust law and technology at Berkeley Law and University of Virginia. Chris has been involved in conservation and environmental causes for over 20 years, and loves spending time on the Bay and shoreline.

Favorite native plant or animal:

Ceanothus and the California quail

Favorite thing to do around the Bay Area:

To be within sight, sound, or scent distance of the Bay, and I love to be on it or in it sailing, kayaking, or treading water

Superpower:

A superhuman capacity to solve problems and enhance lives through design and dialogue

Nancy is a San Francisco native who returned to her hometown after earning a PhD in Art History from Columbia University. She’s taught architectural history at several colleges and universities, including Mills College and UC Davis, and her focus with Save The Bay is to ensure people of all backgrounds and from all parts of the Bay Area can relish the beauty of our Bay.

Favorite native plant or animal:

The Salt Marsh Harvest Mouse because who can say no to that adorable face?

Favorite thing to do around the Bay Area:

Playing with my children in the water at Robert Crown Memorial State Beach or hiking with views of the Bay

Superpower:

To stop time

Rhiannon is the Executive Director of Operations for UC Hastings Law where she oversees sustainability, events, security, planning, and construction. Previously she served at Pepperdine University as the Associate Vice President of Governmental & Regulatory Affairs where she founded their Center for Sustainability and served as Founding Director of the Center.

Bio coming soon

Favorite native plant or animal:

The golden poppy

Favorite thing to do around the Bay Area:

Ride the ferry from the East Bay to San Francisco or Marin

Superpower:

Teleporting

Amy Stoddard’s career has been anchored in the nonprofit sector since 2004, with a focus on fundraising and a specialization in grant writing/management. She joined Save The Bay in 2019, where she guides fund development via foundations/corporate partners. Prior, she managed grants at Planned Parenthood Northern California for four years. She holds a Bachelor’s Degree from UC Santa Cruz in Community Studies, with a minor in Literature.

Favorite native plant or animal:

Sticky Monkey Flower (Diplacus aurantiacus)

Favorite thing to do around the Bay Area:

Rock climb and mountain bike on the East Bay trails

Superpower:

The ability to snap my fingers and be anywhere

Melody is a communications professional with more than a decade of experience working for environmental nonprofits. She moved to the Bay Area from Arcata, CA for college and has been here ever since. In her spare time, she can be found exploring hiking trails and climbing spots near and far. She earned a B.A. in US History from the University of California, Berkeley and resides in Oakland with two friendly rescue cats and a rapidly expanding indoor jungle.

Favorite native plant or animal:

The Seaside Daisy (Erigeron glaucus) – I love that it blooms in the winter, and provides some color when it’s cold and grey outside

Favorite thing to do around the Bay Area:

I learned to ride a bike during the pandemic, and I love biking around the San Francisco Bay Trail

Superpower:

Communicating with animals! I’d like to know what my cats are thinking

Sangeeta is a first-generation Bengali American raised on Piscataway land. They are interested in environmental justice, and are a co-organizer of Brown & Green, a South Asian climate justice group. Outside of work, you can find them baking with foraged fruit or hiking in the East Bay parks.

Favorite native plant or animal:

California wild rose and native succulents

Favorite thing to do around the Bay Area:

I like to hike anywhere that has views of the Bay. One of my favorite hikes on the Bay is at Shoreline Park in Alameda where there is sweeping views of San Francisco

Superpower:

The power of precognition or to be able to see future events

Katie is a charitable fundraiser who has worked for 15 years at leading Bay Area organizations. For nine years prior to joining Save The Bay Katie worked in Development at Planned Parenthood Northern California. Katie is a Bay Area native who feels proud to help protect our beautiful San Francisco Bay and the surrounding communities from the threats of climate change.

Favorite native plant or animal:

Valley oak (Quercus lobata)

Favorite thing to do around the Bay Area:

Hike to earn stunning views and spot seasonal wildflowers

Superpower:

Time travel – specifically to go back in time and view the Bay landscapes throughout history

Jessie Olson is Save The Bay’s Habitat Restoration Director. In nearly eight years at Save The Bay, she built our diverse set of native plant nurseries to support new, larger transition zone habitat restoration projects on the shoreline. We’ve propagated and installed more than 300,000 native plants under her leadership. Jessie brings over 13 years of experience working in natural resource management, habitat restoration, and project implementation to the organization.

Favorite native plant or animal:

When the poppies are blooming

Favorite thing to do around the Bay Area:

Hiking and taking advantage of the variety of landscapes around the Bay Area

Superpower:

Shapeshifting! You could be a bird one day and a sea lion another

Josh is the Policy Manager for Save The Bay working to secure funding to restore Bay wetlands and enact regulations to restrict pollution and promote climate adaptation. Prior to joining Save The Bay, Josh worked as a federal legislative staffer for both the U.S. Senate and House of Representatives.

Favorite native plant or animal:

Anna’s Hummingbird and Toxicodendron diversilobum

Favorite thing to do around the Bay Area:

Hike

Superpower:

The ability to fly

Erica is a lifelong resident of the Bay Area. Her career path has consisted of honing accounting, office administration and management skills in different iterations for about 15 years. She spends her free time with friends, enjoying local restaurants, watching bands, and exploring nature. She feels lucky to work for an organization that is so closely aligned with her deepest intentions to protect and repair our beautiful Bay.

Favorite native plant or animal:

Mountain lion

Favorite thing to do around the Bay Area:

Jumping in the water

Superpower:

The ability to fly

Jesse is the Restoration Program Manager at Save the Bay. She comes from a background in conservation education and people operations and has a passion for building connections between people and place. She is drawn to shoreline ecosystems because of the complexities of these habitats and the need for collaborative human engagement to protect and restore these systems. Some of her favorite parts of a workday include witnessing native seedlings emerge from the soil and hearing students share what they think of when they picture the San Francisco Bay.

Favorite native plant or animal:

California Brown Pelican

Favorite thing to do around the Bay Area:

Exercising outdoors and taking advantage of the great year round weather, playing pickup basketball at local parks like San Pablo Park, and running/biking through the East Bay out to the end of the Emeryville Marina

Superpower:

The ability to fly

Henry was born in Cleveland, Ohio, but spent the majority of his childhood in Washington, DC. He attended Skidmore College and majored in Environmental Studies, discovering his passion for environmental research while studying abroad in Panama. Prior to joining Save The Bay, Henry worked in the workforce development field, primarily developing and expanding programs supporting individuals with barriers to employment.

Favorite native plant or animal:

California newt

Favorite thing to do around the Bay Area:

Long bike rides along the shoreline and across bridges

Superpower:

Time travel

Robin has worked in the nonprofit sector for 25 years with a focus on finance and human resources. She received a B.A. in International Relations and Japanese from UC Davis and recently finished a five year term on the Board of Directors for Diabetes Youth Families. Out in the wild you’re likely to find Robin hiking, biking, paddle boarding, or gardening with her son.

Favorite native plant or animal:

California sagebrush

Favorite thing to do around the Bay Area:

Walk along the levees at Eden Landing and enjoy the views from Angel Island

Superpower:

Fly

Allison is the Political Director at Save The Bay, where she works to advance equitable climate adaptation, sustainable development, and Bay health through policy and advocacy. Prior to Save The Bay, Allison worked for the Ocean Foundation’s Coastal Ocean Values Center, developing economic indicators of ecosystem health in Santa Monica Bay, Morro Bay, and Elkhorn Slough. Allison has a Master’s degree in Environmental Science and Management from the Bren School at UC Santa Barbara.

Favorite native plant or animal:

Red-shouldered Hawk

Favorite thing to do around the Bay Area:

Trail run

Superpower:

Breathe underwater

Justin is a dedicated member of the Policy Team at Save The Bay. As a lifelong devotee to environmental policy and conservation, Justin was drawn to Save The Bay’s mission to advance climate resilience, restore wetlands, and protect vulnerable communities. Justin double-majored in environmental studies and political science at UC Santa Barbara. In August 2022, he will attend UC Hastings College of the Law to pursue a career in environmental law.

Favorite native plant or animal:

Yarrow

Favorite thing to do around the Bay Area:

Hike around Redwood Regional park

Superpower:

Astral Phasing

Gem is Save The Bay’s Operations Manager. They were born & raised in the island of Guåhan, but moved to the Bay Area in 2015 and has been living on Ohlone land ever since. Outside of Save The Bay, Gem enjoys playing guitar and percussion with their band, Coraza, and has a deep love for being involved with Bay Area organizations that focus on Queer and Trans liberation and the Arts, including API Equality of Northern California (APIENC) and Kearny Street Workshop.

Millie brings a wealth of experience working with native plants from seed collection to habitat restoration in the field, including work with the Golden Gate National Parks Conservancy in overseeing seed collection of over 50 native species in the Presidio. Millie is a Certified UC Climate Steward and is passionate about engaging members of the public to realize their own power and role in combatting climate change. We’re excited for them to bring their science communication and volunteer management skills to our team.

Karen Campbell (she/her/hers) is a strategic development professional with 20 years of dedicated experience in the social sector and a passionate advocate for the environment. Over her career, Karen has led programs and fundraised for youth environmental education programs that develop environmental literacy and foster young stewards of the environment. Prior to the impact of the pandemic, Karen served as the Leadership Gifts Manager at NatureBridge. Karen holds a Master in Nonprofit Administration from University of San Francisco School of Management, as well as, a Bachelor of Science in Environmental and Biological Sciences from Antioch College, Yellow Springs, Ohio. She enjoys spending time in nature, teaching Pilates and tending to her community garden plot.